快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出329题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

IAS 10 Events after the reporting period regulates the extent to which events after the reporting period should be reflected in

financial statements.

Which one of the following lists of such events consists only of items that, according to IAS 10, should normally be classified

as non-adjusting?

Which of the following events occurring after the reporting period are classified as adjusting, if material?

1 The sale of inventories valued at cost at the end of the reporting period for a figure in excess of cost

2 A valuation of land and buildings providing evidence of an impairment in value at the year end

3 The issue of shares and loan notes

4 The insolvency of a customer with a balance outstanding at the year end

The financial statements of Overexposure Co for the year ended 31 December 20X1 are to be approved

on 31 March 20X2. Before they are approved, the following events take place.

1 On 14 February 20X2 the directors took the strategic decision to sell their investment in Quebec Co despite the fact that this investment generated material revenues.

2 On 15 March 20X2, a fire occurred in the eastern branch factory which destroyed a material amount of inventory. It is

estimated that it will cost $505,000 to repair the significant damage done to the factory.

3 On 17 March 20X2, a customer of Overexposure Co went into liquidation. Overexposure has been advised that it is unlikely

to receive payment for any of the outstanding balances owed by the customer at the year end.

How should these events reflected in the financial statements at 31 December 20X1?

Adjust Disclose Do nothing

Which of the following events between the reporting date and the date the financial statements are authorised for issue must

be adjusted in the financial statements?

1 Declaration of equity dividends

2 Decline in market value of investments

3 The announcement of changes in tax rates

4 The announcement of a major restructuring

Which of the following is the correct definition of an adjusting event after the reporting period?

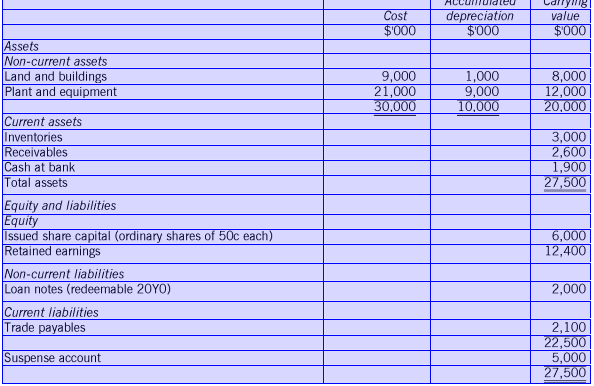

The statement of financial position as at 31 October 20X6

材料全屏

53

【简答题】

The proceeds of issue of 4,000,000 50c shares at $1.10 per share, credited to the suspense account from the cash book.

The balance of the account is the proceeds of sale of some plant on 1 January 20X4 with a carrying amount at the date of sale of $700,000 and which had originally cost $1,400,000. No other accounting entries have yet been made for the disposal apart

from the cash book entry for the receipt of the proceeds. Depreciation on plant has been charged at 25% (straight line basis)

in preparing the draft statement of financial position without allowing for the sale. The depreciation for the year relating to the

plant sold should be adjusted for in full.

材料全屏

55

【简答题】

Closing inventory has been counted and is valued at $75,000.

The items listed below should be apportioned as indicated.

Cost of Distribution Administrativesales costs expenses

% % %

Discounts received - - 100

Energy expenses 40 20 40

Wages 40 25 35

Directors' remuneration - - 100