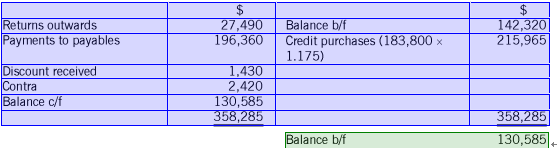

At 1 April 20X9, the payables ledger control account showed a balance of $142,320. At the end of April the following totals are extracted from the subsidiary books for April:

$

Purchases day book 183,800

Returns outwards day book 27,490

Returns inwards day book 13,240

Payments to payables, after deducting $1,430 cash discount 196,360

It is also discovered that:

(a) The purchase day book figure is net of sales tax at 17.5%; the other figures all include sales tax.

(b) A customer's balance of $2,420 has been offset against his balance of $3,650 in the payables ledger.

(c) A supplier's account in the payables ledger, with a debit balance of $800, has been included on the list of payables as

a credit balance

What is the corrected balance on the payables ledger control account?