快速查题-ACCA英国注册会计师试题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

This question appeared in the June 2015 exam.

A division is considering investing in capital equipment costing $2.7m. The useful economic life of the equipment is expected to be 50 years, with no resale value at the end of the period. The forecast return on the initial investment is 15% per annum before depreciation. The division's cost of capital is 7%?

What is the expected annual residual income of the initial investment?

This question appeared in the June 2015 exam.

At the start of the year, a division has non-current assets of $4 million and makes no additions or disposals during the year. Depreciation is charged at a rate of 10% per annum on all non-current assets held at the end of the year. Working capital is $0.5 million at the start of the year although this is expected to increase by 20% by the end of the year. The budgeted profit of the division after depreciation is $1.2 million.

What is the expected ROI of the division for the year, based on average capital employed?

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking.

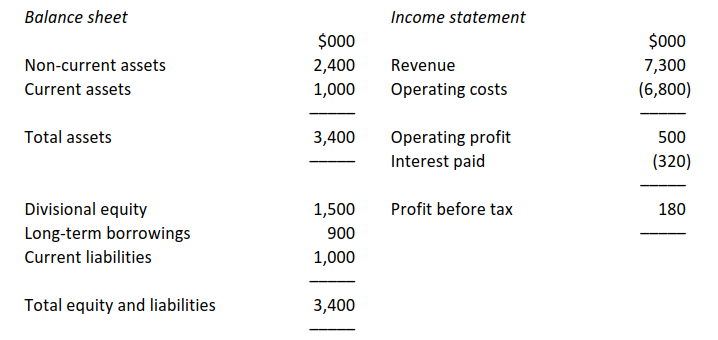

Summary financial statements are given below for JE, the division of a large divisionalised company:

The cost of capital for the division is estimated at 11% each year. The annual rate of interest on the long-term loans is 9%. All decisions concerning the division’s capital structure are taken by central management.

What is the divisional return on capital employed (ROCE) for the year ended 31 December?

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking.

Pro is a division of Mo and is an investment centre. The head office controls finance, HR and IT expenditure but all other decisions are devolved to the local centres.

The statement of financial position for Pro shows net value of all assets and liabilities to be $4,500m. It carries no debt itself although the group has debt liabilities.

The management accounts for income read as follows:

$m

Revenue 3,500

Cost of sales 1,800

Local administration 250

IT costs 50

Distribution 80

Central administration 30

Interest charges 90

Net profit 1,200

Ignore taxation.

If the cost of capital is 12%, what is the division’s residual income?

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking.

Pro is a division of Mo and is an investment centre. The head office controls finance, HR and IT expenditure but all other decisions are devolved to the local centres.

The statement of financial position for Pro shows net value of all assets and liabilities to be $4,500m at the start of the year and $4,890m at the end. It carries no debt itself although the group has debt liabilities.

The management accounts for income read as follows:

$m

Revenue 3,500

Cost of sales 1,800

Local administration 250

IT costs 50

Distribution 80

Central administration 30

Interest charges 90

Net profit 1,200

Ignore taxation.

What is the divisional ROI to the nearest % point?

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking.

At the end of 20X1, an investment centre has net assets of $1m and annual operating profits of $190,000. However, the bookkeeper forgot to account for the following:

A machine with a net book value of $40,000 was sold at the start of the year for $50,000, and replaced with a machine costing $250,000. Both the purchase and sale are cash transactions. No depreciation is charged in the year of purchase or disposal. The investment centre calculates return on investment (ROI) based on closing net assets.

Assuming no other changes to profit or net assets, what is the return on investment (ROI) for the year?

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking.

TM plc makes components which it sells internally to its subsidiary RM Ltd, as well as to its own external market.

The external market price is $24.00 per unit, which yields a contribution of 40% of sales. For external sales, variable costs include $1.50 per unit for distribution costs, which are not incurred on internal sales.

TM plc has sufficient capacity to meet all of the internal and external sales. The objective is to maximise group profit.

At what unit price should the component be transferred to RM Ltd?

A division with capital employed of $400,000 currently earns an ROI of 22%. It can make an additional investment of $50,000 for a five year life with nil residual value. The average net profit from this investment would be $12,000 after depreciation. The division's cost of capital is 14%.

What are the residual incomes before and after the investment?

The transfer pricing system operated by a divisional company has the potential to make a significant contribution towards the achievement of corporate financial objectives.

Required

Explain the potential benefits of operating a transfer pricing system within a divisionalised company.

Choose the correct words from those highlighted.

ROI based on profits as a % of net assets employed will (a) increase/decrease as an asset gets older and its book value (b) increases/reduces. This could therefore create an (c) incentive/disincentive to investment centre managers to reinvest in new or replacement assets.