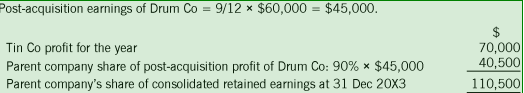

Tin Co acquired 90% of the equity share capital of Drum Co on 1 April 20X3. The following information relates to the financial year to 31 December 20X3 for each company.

Tin Co $’000 Drum Co $’000

Retained earnings at 1 January 20X3 840 170

Profit for the year 70 60

Retained earnings at 31 December 20X3 910 230

Neither company paid any dividends during the year

What profit is attributable to the parent company in the consolidated statement of profit or loss of the Tin Group for the year to 31 December 20x3?