Original standard cost = 0.5 hours × $16 per hour = $8 per unit

Revised standard = 0.6 hours × $15 per hour = $9 per unit

Planning and operational variances for labour are calculated in a similar way to planning and operational variances for materials. We need to look at planning and operational variances for labour rate and labour efficiency.

Labour rate planning variance

This is the difference between the original standard rate per hour and the revised standard rate per hour.

$ per hour

Original standard rate 16

Revised standard rate 15

Labour rate planning variance 1 (F)

The planning variance for labour rate is favourable, because the revised hourly rate is lower than in the original standard. The variance is converted into a total monetary amount by multiplying the planning variance per hour by the actual number of hours worked.

Labour rate planning variance = 8,700 hours × $1 (F) = $8,700 (F).

Labour efficiency planning variance

This is the difference between the original standard time per unit and the revised standard time, for the quantity of units produced. The efficiency planning variance is converted into a total monetary value by applying the original standard rate per hour, not the revised standard rate.

Hours

14,000 units of product should take: original standard (× 0.5) 7,000

14,000 units of product should take: revised standard (× 0.6) 8,400

Labour efficiency planning variance in hours 1,400 (A)

Original standard rate per hour $16

Labour efficiency planning variance in $ $22,400 (A)

The planning variance is adverse because the revised standard is for a longer time per unit (so higher cost and lower profit).

Labour rate operational variance

This is calculated using the actual number of hours worked and paid for.

$

8,700 hours should cost (revised standard $15) 130,500

They did cost 130,500

Labour rate operational variance 0

In this example, the workforce was paid exactly the revised rate of pay per hour.

Labour efficiency operational variance

This variance is calculated by comparing the actual time to make the output units with the standard time in the revised standard. It is then converted into a monetary value by applying the original standard rate per hour.

Hours

14,000 units of product should take (× 0.6 hours) 8,400

They did take 8,700

Labour efficiency (operational variance in hours) 300 (A)

Original standard rate per hour $16

Labour efficiency (operational variance in $) $4,800 (A)

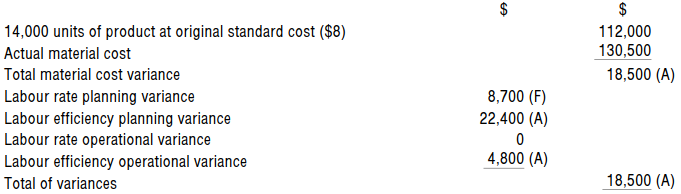

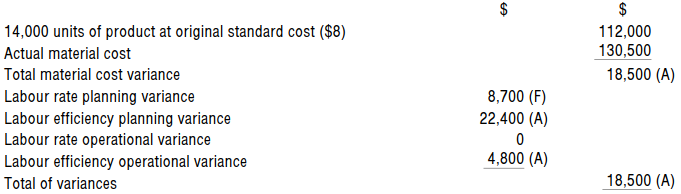

The variances may be summarised as follows.