快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出329题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

Which of the following items could appear in a company's statement of cash flows?

1 Surplus on revaluation of non-current assets

2 Proceeds of issue of shares

3 Proposed dividend

4 Irrecoverable debts written off

5 Dividends received

Part of the process of preparing a company's statement of cash flows is the calculation of cash inflow from operating activities.

Which of the following statements about that calculation (using the indirect method) are correct?

1 Loss on sale of operating non-current assets should be deducted from net profit before taxation.

2 Increase in inventory should be deducted from operating profits.

3 Increase in payables should be added to operating profits.

4 Depreciation charges should be added to net profit before taxation.

In the course of preparing a company's statement of cash flows, the following figures are to be included in the calculation of

net cash from operating activities

$

Depreciation charges 980,000

Profit on sale of non-current assets 40,000

Increase in inventories 130,000

Decrease in receivables 100,000

Increase in payables 80,000

What will the net effect of these items be in the statement of cash flows?

Part of a company's draft statement of cash flows is shown below:

$!000

Net profit before tax 8,640

Depreciation charges (2,160)

Proceeds of sale of non-current assets 360

Increase in inventory (330)

Increase in accounts payable 440

The following criticisms of the above extract have been made:

1 Depreciation charges should have been added, not deducted.

2 Increase in inventory should have been added, not deducted.

3 Increase in accounts payable should have been deducted, not added.

4 Proceeds of sale of non-current assets should not appear in this part of the statement of cash flows.

Which of these criticisms are valid?

In preparing a company's statement of cash flows complying with IAS 7 Statements of Cash FIOWS

which, if any, of the following items could form part of the calculation of cash flow from financing activities?

1 Proceeds of sale of premises

2 Dividends received

3 Bonus issue of shares

Which of the following assertions about statement of cash flows is/are correct?

1 A statement of cash flows prepared using the direct method produces a different figure for operating cash flow from that

produced if the indirect method is used.

2 Rights issues of shares do not feature in statements of cash flows.

3 A surplus on revaluation of a non-current asset will not appear as an item in a statement of cash flows.

4 A profit on the sale of a non-current asset will appear as an item under Cash Flows from Investing Activities in a statement

of cash flows.

An extract from a statement of cash flows prepared by a trainee accountant is shown below. Cash flows from operating

activities Net profit before taxation Adjustments for: Depreciation Operating profit before working capital changes Decrease in inventories Increase in receivables Increase in payables Cash generated from operations Which of the following criticisms of

this extract are correct?

1 Depreciation charges should have been added, not deducted.

2 Decrease in inventories should have been deducted, not added.

3 Increase in receivables should have been added, not deducted.

4 Increase in payables should have been added, not deducted.

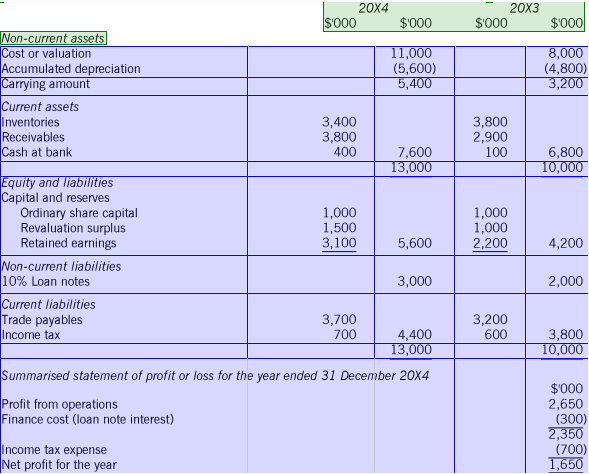

The following information is available for Sioux, a limited liability company:Statements of financial position

1 During the year non-current assets which had cost $800,000, with a carrying amount of $350,000, were sold for $500,000.

2 The revaluation surplus arose from the revaluation of some land that was not being depreciated.

3 The 20X3 income tax liability was settled at the amount provided for at 31 December 20X3.

4 The additional loan notes were issued on 1 January 20X4. Interest was paid on 30 June 20X4 and 31 December 20X4.

5 Dividends paid during the year amounted to $750,000.

Prepare the company's statement of cash flows for the year ended 31 December 20X4, using the indirect method, adopting

the format in IAS 7 Statement of cash flows.

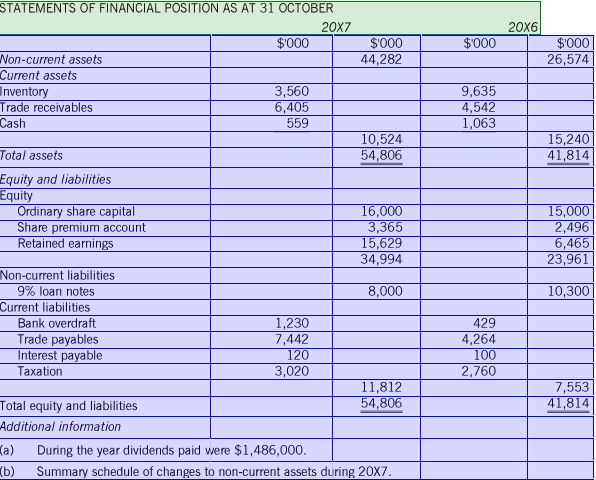

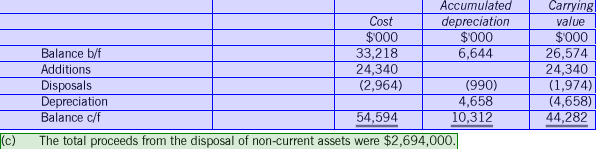

Geofost is preparing its statement of cash flows for the year ended 31 October 20X7. You have been presented with the

following information.

GEOFOST

STATEMENT OF PROFIT OR LOSS FOR THE YEAR ENDED 31 OCTOBER 20X7

Profit from operations 15,730

Finance cost (730)

Profit before tax 15,000

Taxation (4,350)

Profit for the year 10,650

Required

Prepare a statement of cash flows for Geofost for the year ended 31 October 20X7 in accordance with IAS 7 Statement of

cash flows, using the indirect method.

In finalising the financial statements of a company for the year ended 30 June 20X4, which of the following material matters

should be adjusted for?

1 A customer who owed $180,000 at the end of the reporting period went bankrupt in July 20X4.

2 The sale in August 20X4 for $400,000 of some inventory items valued in the statement of financial position at $500,000.

3 A factory with a value of $3,000,000 was seriously damaged by a fire in July 20X4. The factory was back in production by

August 20X4 but its value was reduced to $2,000,000.

4 The company issued 1,000,000 ordinary shares in August 20X4.