快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出20题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

Prepare the consolidated statement of profit or loss for Liverton for the year ended 31 May 20X6.

材料全屏

19

【论述题】

Calculate the following ratios for Binky and Smokey:

(State the formulae used for calculating the ratios.)

Profitability ratios

Gross profit percentage

Net profit percentage

Asset turnover ratio

Liquidity ratios

Current ratio

Quick ratio (acid test ratio)

Receivables collection period

Compare and comment on the performance of the companies as indicated by the ratios you havecalculated in part (1).

Which of the following transactions would result in an increase in capital employed?

From the following information regarding the year to 31 August 20X6, what is the accounts payable payment period? You

should calculate the ratio using purchases as the denominator.

$

Sales 43,000

Cost of sales 32,500

Opening inventory 6,000

Closing inventory 3,800

Trade accounts payable at 31 August 20X6 4,750

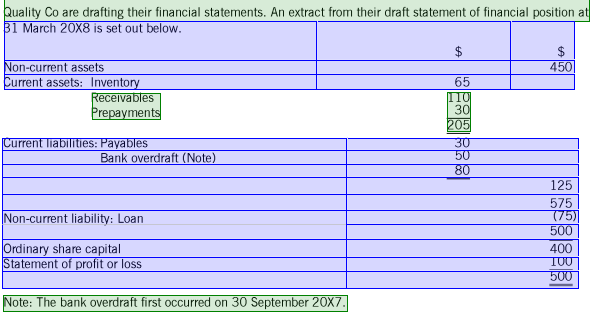

What is the gearing of the company? You should calculate gearing using capital employed as the denominator.

What is the quick ratio of the company?

What is the current ratio of the company?

Which one of the following would help a company with high gearing to reduce its gearing ratio?

A company's gross profit as a percentage of sales increased from 24% in the year ended 31 December 20X1 to 27% in the

year ended 31 December 20X2.

Which of the following events is most likely to have caused the increase?