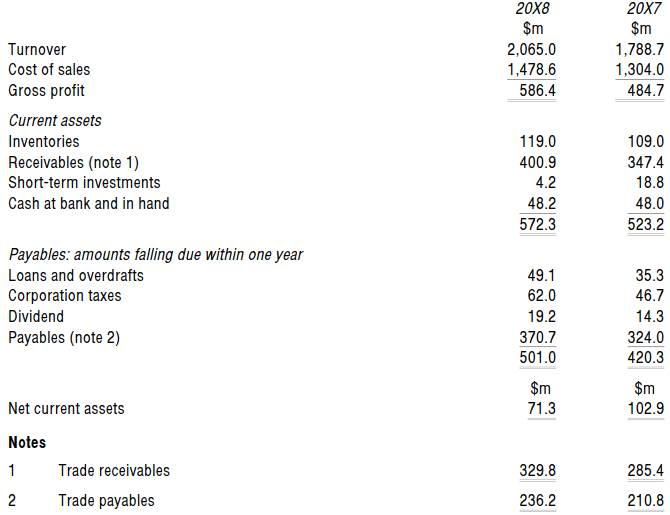

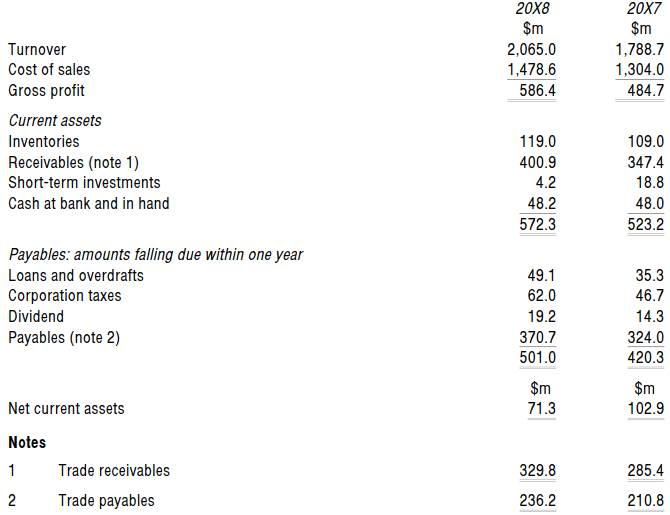

Calculate liquidity and working capital ratios from the accounts of a manufacturer of products for the construction industry, and comment on the ratios.

Calculate liquidity and working capital ratios from the accounts of a manufacturer of products for the construction industry, and comment on the ratios.

As a manufacturing group serving the construction industry, the company would be expected to have a comparatively lengthy receivables turnover period, because of the relatively poor cash flow in the construction industry. It is clear that the company compensates for this by ensuring that they do not pay for raw materials and other costs before they have sold their inventories of finished goods (hence the similarity of receivables and payables turnover periods).

The company's current ratio is a little lower than average but its quick ratio is better than average and only slightly lower than the current ratio. This suggests that inventory levels are strictly controlled, which is reinforced by the low inventory turnover period. It would seem that working capital is tightly managed, to avoid the poor liquidity which could be caused by a high receivables turnover period and comparatively high payables.

多做几道

What objectives might the following not for profit organisations have?

(a) An army (d) A political party

(b) A local council (e) A college

(c) A charity

One of the objectives of a local government body could be 'to provide adequate street lighting throughout the area'.

(a) How could the 'adequacy' of street lighting be measured?

(b) Assume that other objectives are to improve road safety in the area and to reduce crime. How much does 'adequate' street lighting contribute to each of these aims?

(c) What is an excessive amount of money to pay for adequately lit streets, improved road safety and reduced crime? How much is too little?

What general objectives of non profit seeking organisations are being described in each of the following?

(a) Maximising what is offered

(b) Satisfying the wants of staff and volunteers

(c) Equivalent to profit maximisation

(d) Matching capacity available

A division with capital employed of $400,000 currently earns an ROI of 22%. It can make an additional investment of $50,000 for a five year life with nil residual value. The average net profit from this investment would be $12,000 after depreciation. The division's cost of capital is 14%.

What are the residual incomes before and after the investment?

The transfer pricing system operated by a divisional company has the potential to make a significant contribution towards the achievement of corporate financial objectives.

Required

Explain the potential benefits of operating a transfer pricing system within a divisionalised company.

最新试题

该科目易错题

该题目相似题