快速查题-ACCA英国注册会计师试题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

A government body uses measures based on the 3Es to measure value for money generated by a publicly funded hospital. It considers the most important performance measure to be 'cost per successfully treated patient'

Which of the 3Es best describes the above measure?

Which TWO of the following are most likely to be performance measures for a not for profit organisation?

(1) Efficient resource allocation.

(2) Return on investment (ROI) and residual income (RI)

(3) Minimising the cost of resources used.

(4) Success measured against competition

Which of the following is an example of an internal stakeholder?

What objectives might the following not for profit organisations have?

(a) An army (d) A political party

(b) A local council (e) A college

(c) A charity

One of the objectives of a local government body could be 'to provide adequate street lighting throughout the area'.

(a) How could the 'adequacy' of street lighting be measured?

(b) Assume that other objectives are to improve road safety in the area and to reduce crime. How much does 'adequate' street lighting contribute to each of these aims?

(c) What is an excessive amount of money to pay for adequately lit streets, improved road safety and reduced crime? How much is too little?

What general objectives of non profit seeking organisations are being described in each of the following?

(a) Maximising what is offered

(b) Satisfying the wants of staff and volunteers

(c) Equivalent to profit maximisation

(d) Matching capacity available

【论述题】

The absence of the profit measure in non profit seeking organisations causes problems for the measurement of their efficiency and effectiveness.

Required

(i) Explain why the absence of the profit measure should be a cause of the problems referred to.

(ii) Explain how these problems extend to activities within business entities which have a profit motive. Support your answer with examples.

This question appeared in the June 2015 exam.

A division is considering investing in capital equipment costing $2.7m. The useful economic life of the equipment is expected to be 50 years, with no resale value at the end of the period. The forecast return on the initial investment is 15% per annum before depreciation. The division's cost of capital is 7%?

What is the expected annual residual income of the initial investment?

This question appeared in the June 2015 exam.

At the start of the year, a division has non-current assets of $4 million and makes no additions or disposals during the year. Depreciation is charged at a rate of 10% per annum on all non-current assets held at the end of the year. Working capital is $0.5 million at the start of the year although this is expected to increase by 20% by the end of the year. The budgeted profit of the division after depreciation is $1.2 million.

What is the expected ROI of the division for the year, based on average capital employed?

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking.

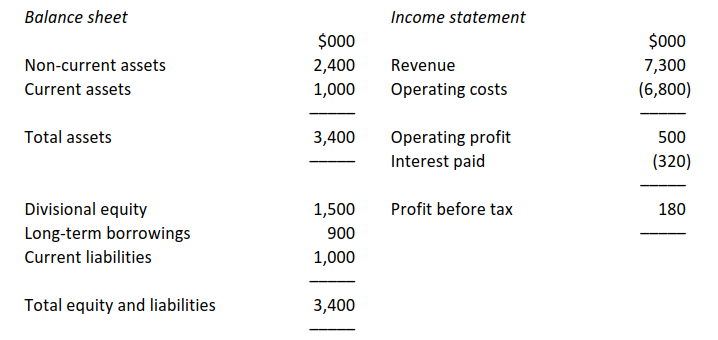

Summary financial statements are given below for JE, the division of a large divisionalised company:

The cost of capital for the division is estimated at 11% each year. The annual rate of interest on the long-term loans is 9%. All decisions concerning the division’s capital structure are taken by central management.

What is the divisional return on capital employed (ROCE) for the year ended 31 December?