快速查题-ACCA英国注册会计师试题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

【论述题】

Compare and contrast the use of residual income and return on investment in divisionalperformance measurement, stating the advantages and disadvantages of each.

Division Y of Chardonnay currently has capital employed of $100,000 and earns an annual profit after depreciation of $18,000. The divisional manager is considering an investment of $10,000 in an asset which will have a ten-year life with no residual value and will earn a constant annual profit after depreciation of $1,600. The cost of capital is 15%.

Calculate the following and comment on the results.

(i) The return on divisional investment before and after the new investment

(ii) The divisional residual income before and after the new investment

Explain the potential benefits of operating a transfer pricing system within a divisionalised company.

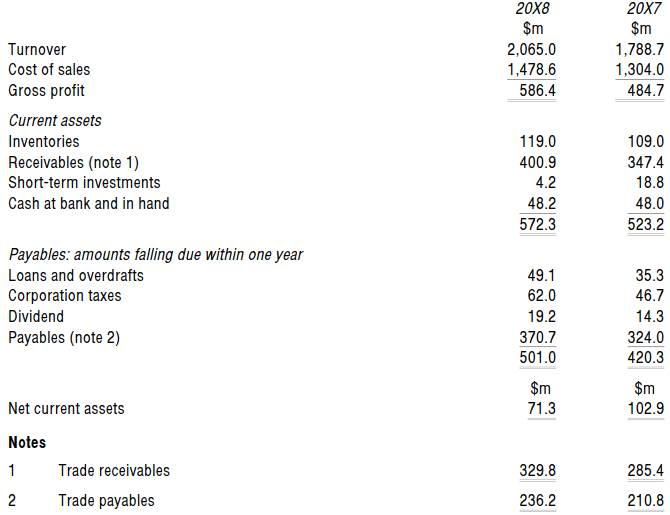

Calculate liquidity and working capital ratios from the accounts of a manufacturer of products for the construction industry, and comment on the ratios.

Suggest two separate performance indicators that could be used to assess each of the following areas of a fast food chain's operations.

(a) Food preparation department

(b) Marketing department

Give five examples of a financial performance measure.

How do quantitative and qualitative performance measures differ?

Choose the correct words from those highlighted.

In general, a current ratio in excess of 1/less than 1/approximately zero should be expected.

Fill in the blanks.

NFPIs are less likely to be …………………. than traditional profit-related measures and they should therefore offer a means of counteracting ………………………….. .

What are the three most important features of the balanced scorecard approach?