快速查题-ACCA英国注册会计师试题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

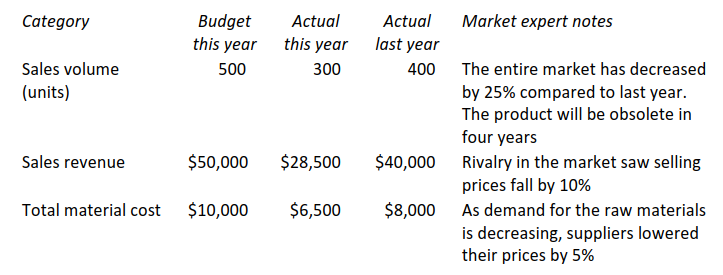

A profit centre manager claims that the poor performance of her division is entirely due to factors outside her control. She has submitted the following table along with notes from a market expert, which she believes explains the cause of the poor performance:

After adjusting for the external factors outside the manager’s control, in which category/categories is there evidence of poor performance?

After adjusting for the external factors outside the manager’s control, in which category/categories is there evidence of poor performance?

The following statements have been made about planning and operational variances:

(1) Planning and operational variances are calculated when it is necessary to assess a manager on results that are within his/her control.

(2) Revised standards are required because variances may arise partly due to an unrealistic budget, and not solely due to operational factors.

Which of the above statement(s) is/are true?

If a planning efficiency variance is valued at an original standard rate, the planning rate variance is valued at the original efficiency level.

A company sells a single product. Budgeted and actual sales data for the period just ended are as follows.

The budget was based on an expectation that the company would maintain its 20% share of the market. It was subsequently recognised that the actual market size, due to unforeseen changes in customer buying behaviour, was only 90,000 units. It was therefore decided to report sales volume variances as a market share variance and a market size variance.

What was the market share variance, and should this be controllable by operational sales managers?

This question appeared in the June 2015 exam.

Caf Co budgeted to sell 10,000 units of a new product in the period at a budgeted selling price of $5 per unit. Actual sales volumes in the period were as budgeted but the actual sales price achieved was only $4 per unit. This was because a competitor launched a similar product at the same time. Caf Co had been aware that this was going to happen when it prepared its budget and, had it known this, it would have revised its expected selling price to $3.80 per unit, which was the price of the competitor's product.

What is the sales price planning variance?

This question appeared in the June 2015 exam.

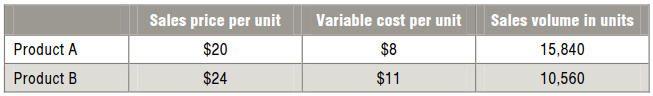

The following budgeted data for a particular period was available for a company selling two products:

The actual results for the period were as follows:

What is the sales quantity contribution variance?

Which of the following variances should a production manager be held responsible for?

PG budgeted sales for 20X8 were 5,000 units. The standard contribution is $9.60 per unit. A recession in 20X8 meant that the market for PG's products declined by 5%. PG's market share also fell by 3%. Actual sales were 4,500 units.

Required

Calculate planning and operational variances for sales volume.

KSO budgeted to sell 10,000 units of a new product during 20X0. The budgeted sales price was $10 per unit, and the variable cost $3 per unit. Actual sales in 20X0 were 12,000 units and variable costs of sales were $30,000, but sales revenue was only $5 per unit. With the benefit of hindsight, it is realised that the budgeted sales price of $10 was hopelessly optimistic, and a price of $4.50 per unit would have been much more realistic.

Required

Calculate planning and operational variances for sales price.

A company makes a single product. At the beginning of the budget year, the standard labour cost was established as $8 per unit, and each unit should take 0.5 hours to make.

However, during the year, the standard labour cost was revised. A new quality control procedure was introduced to the production process, adding 20% to the expected time to complete a unit. In addition, due to severe financial difficulties facing the company, the workforce reluctantly agreed to reduce the rate of pay to $15 per hour.

In the first month after revision of the standard cost, budgeted production was 15,000 units but only 14,000 units were actually produced. These took 8,700 hours of labour time, which cost $130,500.

Required

Calculate the labour planning and operational variances in as much detail as possible.